DeFi is short for decentralized finance, an umbrella term for a variety of financial applications that aim to disrupt financial intermediaries. To establish trust, DeFi relies heavily on cryptography, blockchain, and smart contracts. Smart contracts are the key building blocks of DeFi - enabling trusted transactions and agreements between multiple, anonymous parties without the need for a central authority, legal system, or external enforcement mechanism. Since this form of agreement between buyer and seller is written directly in lines of code. The code controls the execution itself, and the transactions are traceable and irreversible.

Pretty much all DeFi projects are based on Ethereum, probably once because of the relatively robust programming language Solidity and the developed ecosystem for all smart contract platforms with thousands of developers continuously developing new applications.

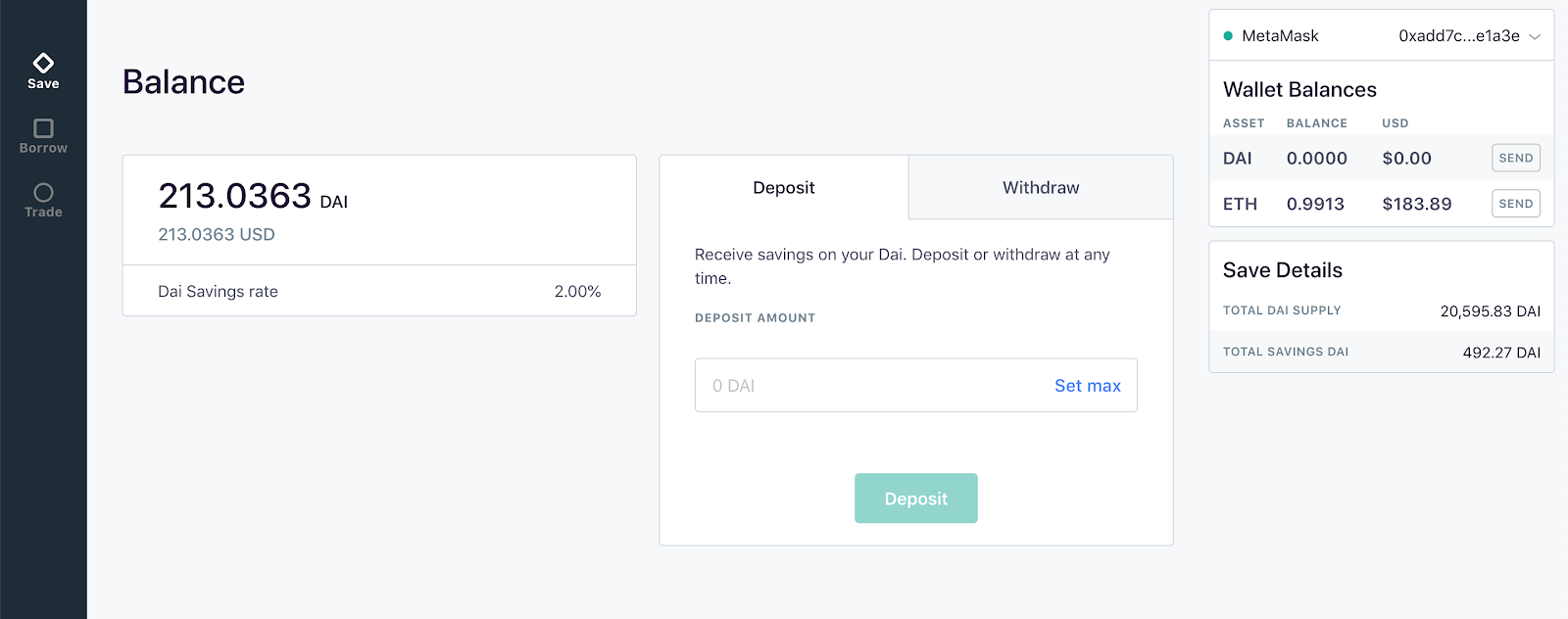

One of the early innovators shaping the decentralized finance movement was MakerDAO, founded in 2014 in Santa Cruz, California. The platform allows its users to embed collateral such as ETH and generate DAI. DAIs are stablecoins that are pegged to the U.S. dollar exchange rate through certain incentives. DAIs can also be used for trading, borrowing, and saving on MakerDAOs Oasis platform – which restores one of the pillars of the financial system.

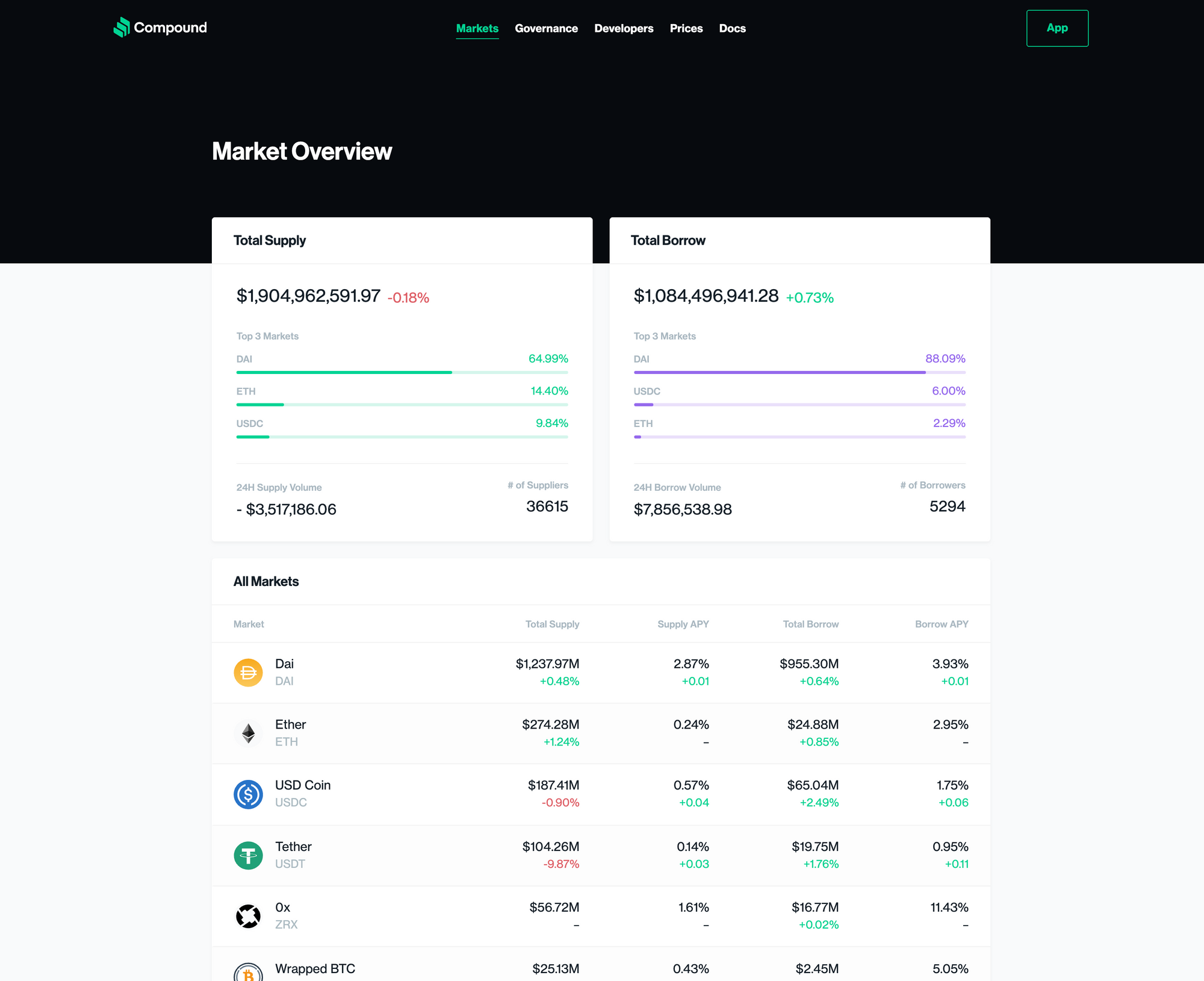

There are several other important DeFi projects. Another major player in the credit category is Compound. Compound was founded in 2017 and is headquartered in San Francisco. The company has currently received Series A funding (including from a16z, BainCapital Ventures, Draper Capital, Polychain Capital, etc.) with a total funding amount of USD 33.2 million. Assets worth about USD 630 million are locked up in the protocol. Compound is an algorithmic autonomous interest protocol that allows users to supply assets such as ETH, BAT, 0x, or Tether and start earning interest. The assets provided can also serve as collateral for lending other assets.

Aave is also worth a mention in the lending category. Their protocol allows users to borrow and lend a variety of cryptocurrencies with stable and variable interest rates. Unlike Compound, Aave has notable differentiating features such as unsecured loans, "rate switching," Flash Loan and unique collateral types.

The company also received an electronic money institution license from the United Kingdom's Financial Conduct Authority. Recently, the company launched its Aavenomics Proposal to reward both liquidity providers and AAVE holders who participate in the risk position and keep the protocol safe.

DeFi is trying to create the whole new financial ecosystem in a permission-free and open way. At the same time, lending and borrowing is only one part of this ecosystem. Some of the other important pillars are stablecoins, decentralized exchanges, derivatives, margin trading and insurance.

Stablecoins

There are several backed stablecoins such as USDT (Tether), USDC (USD Coin) or Paxos Standard (PAX). The main problem with them is the fact that they are centralized, as there is a company behind them that is responsible for holding the equivalent of the value of the stablecoins in, say, US$. Each token is backed by money in bank accounts at a ratio of 1:1. So these companies only issue new stablecoin units when they receive the equivalent value in fiat currency.

Some stablecoins are pegged to other cryptocurrencies (crypto-backed stablecoins) instead of fiat or commodity currencies and are often referred to as crypto-backed stablecoins. The peg of these coins is maintained through over-collateralization and stability mechanisms. Again, a well-known example is DAI.

Non-collateralized stablecoins, on the other hand, use algorithms to control the supply of tokens to keep the price at a certain level. The goal of these coins is to maintain a stable value by algorithmically expanding and restricting their circulating supply in response to market behavior. The Carbon Protocol, for example, uses supply reduction by issuing carbon credits through an auction. Users and token holders can bid for carbon credits to burn CUSD, which offers them a discount as the token grows and helps maintain the price. When the value of the token changes, Carbon sells tokens to readjust the price.

Decentralized Exchanges

DEXs (Decentralized Exchanges) - as opposed to standard centralized crypto exchanges like Coinbase or Binance - allow cryptocurrencies to be exchanged in a completely decentralized and permission-free manner. This is especially important because centralized exchanges bring their own risks - namely, custody.

Some of the most notable aspects of DEXs are:

- Non-custodial – Ownership of the underlying assets is never revoked.

- Automated – With no intermediaries, DEX trading is instantaneous as long as there is sufficient liquidity.

- Cost-Effective – Many DEXs have minimal trading fees, allowing users to exchange assets at little or no cost.

- Globally Accessible – Most DEXs do not require registration and are largely counterparty risk free.

- Intuitive – Recent trends have evolved DEX trading from order books to simple point-and-click swaps.

- Pseudo-anonymous – Users simply connect a wallet of their choice to begin trading. No profile or background information is required.

There are two main types of DEXs, one is liquidity pool based and the other is order book based. Liquidity pool-based examples include Uniswap, KyberSwap, Balancer, and Bancor. Loopring Exchange and IDEX are examples of order book-based systems.

Derivatives

Similar to traditional (centralized) financial derivatives, these are contracts that derive their value from the performance of an underlying asset. The main DeFi application in this space, Synthetix, is a decentralized platform that provides on-chain exposure to various assets. A user deposits collateral in the form of SNX tokens to create a synthetic asset. Now, the user can exchange or swap one synthetic asset for another, i.e., re-value the collateral via a price oracle. There is no direct counterparty in this process. Synthetix uses a pooled collateral mechanism, meaning that SNX stakers collectively assume the counterparty risk of other users' synthetic positions.

Derivatives based on DeFi have some inherent advantages that will lead to a portion of the traditional derivatives market moving to decentralized derivatives:

- Decentralized derivatives markets are inherently more accessible. They can be used by anyone with an internet connection and an Ethereum wallet - regardless of their location or social status.

- Creating a custom derivative on DeFi is simple, cheap, and can be done by anyone. In the traditional financial system, the process for creating and listing a new derivative is very complex and the associated costs are close to a million dollars. For this reason, most derivatives are developed by large financial services firms. The Opium Protocol allows users to create a derivative contract from scratch in minutes by combining an on-chain derivative recipe with a price oracle recipe (see later in this article I will talk about blockchain oracles).

In the DeFi space, futures derivatives are essential for traders to hedge positions and reduce the risk of cryptocurrency price volatility. Various derivatives allow traders to profit from the price fluctuations of Bitcoin and major altcoins - for example, buy now at a lower price and sell later at a higher price.

Margin Trading

DeFi Margin Trading again has many similarities with traditional (centralized) finance. Basically, it is the use of borrowed funds to increase a position in a particular asset. The main DeFi applications in margin trading are dYdX and fulcrum.

dYdX takes the approach that all assets on the platform have a borrowing rate and a provisioning rate. In other words, there is no distinction between three different wallets. If you simply deposit ETH, USDC or DAI on the platform, you will start receiving interest immediately. If you deposit ETH and then buy ETH/DAI, you will receive interest for the additional ETH you buy and pay it for the DAI you borrow.

In other protocols, such as Augur or Gnosis, users bet on the outcome of events. In Augur, users can create and exchange "shares" that represent a portion of the value of outcomes such as election results or sports scores.

There is a big difference between an RFQ (Request For Quote) approach, which allows a provider to sell most products at a reasonable price point, taking into account variables related to product, volume, and region. dYdX takes a different approach to prices, where there is theoretically no bid-ask spread, since all assets are eligible for interest, there will always be a spread. For example, with ETH there is a large supply but very little demand to borrow it. Consequently, a small amount of interest must be spread across a large pool of suppliers.

The advantages of this pool-to-pool variation of margin trading:

- Funds provided can be used to initiate margin trades while still earning interest. There is no need to move funds into a funding portfolio where they must remain unencumbered to receive returns.

- There is verification that the correct amount of interest is being paid through the log and that nothing has been taken away.

- For bearish minds, while the rest of the market is bullish (i.e. the market is willing to pay a high interest rate to borrow USDC and DAI against ETH, for example), the user receives the proper amount of interest for being willing to short ETH/USDC and ETH/DAI. In contrast, a margin short on a central exchange for the same pair would only incur interest but earn the user nothing.

- Does not require account registration or disclosure of the user's personal information to other parties.

The disadvantages:

- Assets must be available on the record or nearby. Without a centralized party to facilitate initial liquidity or on an ad hoc basis, there is a chicken and egg situation. Compatibility is likely important to access assets that are on other DeFi protocols and make them available to margin traders.

- Rates can fluctuate dramatically depending on utilization. A few large trades can quickly drive up rates for existing borrowers.

- Liquidations are more expensive as positions are liquidated in a currently less liquid spot market.

Insurance

Insurance is another part of traditional finance that can be represented in DeFi. For example, providers guarantee compensation for a specific loss, damage, illness, or death in exchange for the payment of a premium. An immediate use case is insurance against smart contract failure and deposit protection. DeFi insurance borrows from the traditional insurance market in some of its goals. It protects people and institutions from financial loss due to fraud, theft, or unforeseen infrastructure failure. DeFi insurance can be a valuable hedge if you are uncomfortable with the risk you are taking in DeFi. Popular DeFi projects in this area include Nexus Mutual and Opyn Protection.

Nexus Mutual aims to "take power away from the big insurers and give it back to the individual." They differ from traditional insurance companies in that they are member-driven. And Nexus incentivizes its members to participate in governance, claims assessment and risk evaluation. At Nexus Mutual, anyone can buy insurance. They offer a risk-sharing pool that provides users with simple, transparent protection against their financial risks.

Nexus has already had to make payouts. This is due to the attacks on bZx, a flash loan provider. The bZx exploit occurred after a flaw was found in its smart contract. Fortunately, the funds of the people who had purchased coverage were safe. In this "trial by fire," Nexus was able to remove any doubts in the DeFi community as to whether their community would vote to distribute payouts.

Blockchain Oracles & DeFi

Another important – though not exclusively limited to finance – part of the DeFi ecosystem is blockchain oracles, which focus on feeding reliable data from the outside world into smart contracts. This data can be the price of an asset, election results, supply chain information, or even which team won a soccer match.

It is usually a third-party service or something that is done manually – both of which are usually centralized. It is obvious that a centralized method for oracles defeats the entire purpose of developing a DeFi product. For example, if the oracle were corrupted, it could manipulate the system or censor the data for its own financial gain. Decentralizing this process by which off-chain data is used up the chain is critical to a secure contract.

Since we already talked about MakerDAO – the company uses an oracle module to determine the real-time price of assets. The module consists of addresses of oracles that are whitelisted and an aggregator contract. The oracles send periodic price updates to an aggregator, which determines a median price that is then used as a reference price on the platform.

On the other hand, Compound uses oracles to collect price information, which is then forwarded to its price feed, which is managed and controlled by "administrators" who are holders of Compound's native token, COMP.

The most popular project in this space is Chainlink. Chainlink is currently valued at US$4.475 billion. In contrast, Band Protocol, the second largest oracle project on the market, has a valuation of US$257 million. They currently power most DeFi protocols such as Aave (LEND), Synthetix Network (SNX), Kyber Network (KNC), Loopring (LRC), Ampleforth (AMPL) and Bancor (BNT). In addition, Chainlink announced that Google is integrating Chainlink into its approach to smart contract adoption to demonstrate how users can use Chainlink to connect to BigQuery, one of Google's most popular cloud services. LINK is their digital asset token used to pay for services on the network.

Final Thoughts

Stablecoins, decentralized exchanges, derivatives, margin trading, and insurance are pretty much all mainstays of the DeFi ecosystem. They can certainly be combined in a variety of ways. Think of them as LEGO building blocks that can be built on top of existing blocks.

Let's compare the main differences between DeFi and CeFi:

| DeFi | CeFi |

|---|---|

| Permissionless | Permissioned |

| Open | Closed |

| Censorship Resistant | Can be Censored |

| Cheaper | More Expensive |

| Blockchain-based | Legacy systems |

And finally, a look at potential risks:

One of the main risks is failures in smart contracts and protocol changes that can affect existing contracts. Although DeFi insurance can reduce (but certainly not eliminate) the risk.

Second, there is a need to demonstrate how decentralized a DeFi provider really is. For example, what is the shutdown procedure if something goes wrong? Is there an "admin key" - if so, who is that and can that person shut down the protocol? All of this goes hand in hand with systemic risks that can occur. For example, asset prices can drop sharply in value, leading to a cascade of liquidations across multiple DeFi protocols. Network charges and congestion.

DeFi has been a high-risk, high-reward "game" lately. DeFi is probably the most likely to truly disrupt the traditional financial industry. Most financial products can only be developed by banks. DeFi is open, permission-free, and enables cooperative work in much the same way as the Internet itself.

The website and the information contained therein are not intended to be a source of advice or credit analysis with respect to the material presented, and the information and/or documents contained on this website do not constitute investment advice.