Read the following article first as an introduction to DeFi: Decentralized Finance Will Reshape (or Eat Up?) Centralized Finance.

Ahead - I personally find Yield Farming to be a very controversial topic and it seems I am not the only one. Vitalik Buterin, co-founder of Ethereum and Bitcoin Magazine, criticized the hype and compared yield farming to irresponsible monetary policies of central banks and warned against "naive stubbornness." On his Twitter account, Buterin wrote:

Seriously, the sheer volume of coins that needs to be printed nonstop to pay liquidity providers in these 50-100%/year yield farming regimes makes major national central banks look like they're all run by Ron Paul.

So what is yield farming? Yield Farming is the act of using various DeFi protocols and products to generate a return or profit on their assets, in some cases generating profits well in excess of 100% through a combination of lending rates and token incentives. Yield Farmers therefore seek to achieve the highest return by switching between several different strategies.

** Low Risk Strategies:** Low risk strategies are usually those that are part of fully tested, battle-tested and reputable protocols. They are less lucrative in terms of net returns, but offer safer and more stable returns over the long term. (Example protocols are Curve, Compound, and Balancer)

High-Risk Yield Farming Strategies: High-risk yield farming strategies are brand new, untested, unproven, and usually last only a few days or weeks. (Example protocols are YAM Finance, Yearn.finance)

The most profitable strategies usually include at least a couple of DeFi protocols such as Compound Curve, Synthetics, You and You Swap, or a Balancer. When the strategy stops working or a better strategy is available, yield farmers circulate their funds, for example, between the different protocols or by swapping coins into other protocols that currently yield more. This process is often referred to as crop rotation.

To compare this to traditional finance (centralized finance), imagine people trying to find the best savings account; with the highest APY (Annual Percentage Yield). Depending on the country, it is common for traditional savings accounts to be around 0.1% APY (3% and above is virtually unheard of these days; see Investopedia - Best High-Yield Savings Accounts).

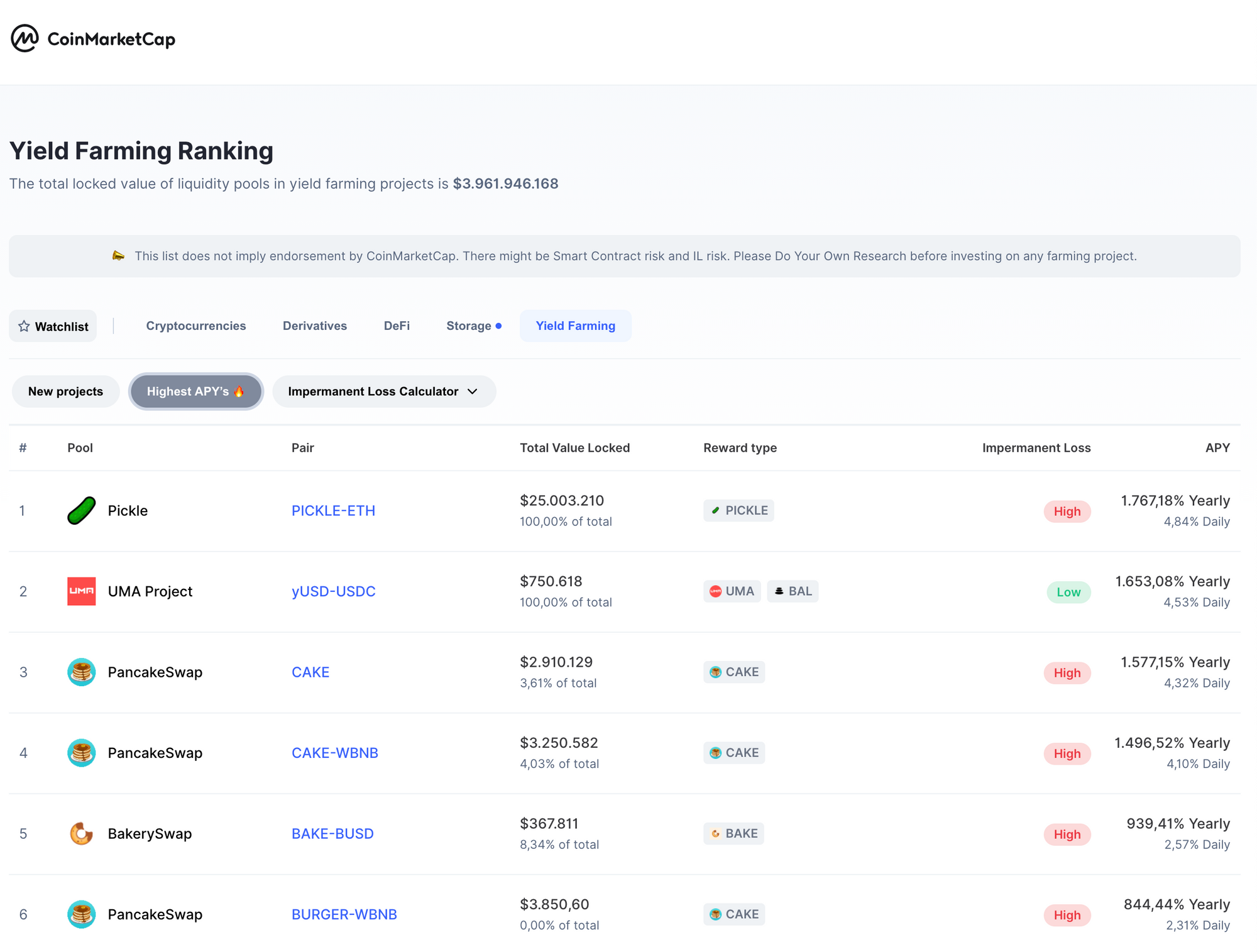

Yield farming APY's could outperform traditional offerings. By comparison, the current "Yield Farm Rankings" on CoinMarketCap illustrate that APY's of several hundred% are achievable at any given time.

How is that possible? And what is the catch? There are three main elements to achieving this return: 1. Liquidity Mining, 2. Leverage, and 3. Risk.

Liquidity Mining

Liquidity mining is a process of distributing tokens to users of a protocol. One of the first DeFi projects to introduce this approach was [Synthetix] (https://www.synthetix.io/). The company began rewarding users who added liquidity to the sETH/ETH pool on Uniswap with SNX tokens.

Liquidity mining creates additional incentives for yield farmers, such as rewarding users with newly minted native tokens. This is all in addition to the revenue already generated by using the specific protocol used. In fact, this is not new by comparison - by the end of 2018, several centralized exchange operators in China were offering liquid mining incentives on their platforms. The most prominent of them was an exchange called FCoin. FCoin offered large incentives to traders who traded on its platform, hoping that the liquidity it created would attract more organic users. FCoin was betting that users would stay on the exchange after the liquidity incentives expired – they closed their services in 2020.

A good example is the mining of COMP tokens, which was originally introduced by Compound. Initially, there were higher rewards for users who borrowed assets with the highest APY. This was an incentive for yield hunters to lend these assets, as the value of the freshly minted COMP token compensated them for the highest lending rates they had to pay.

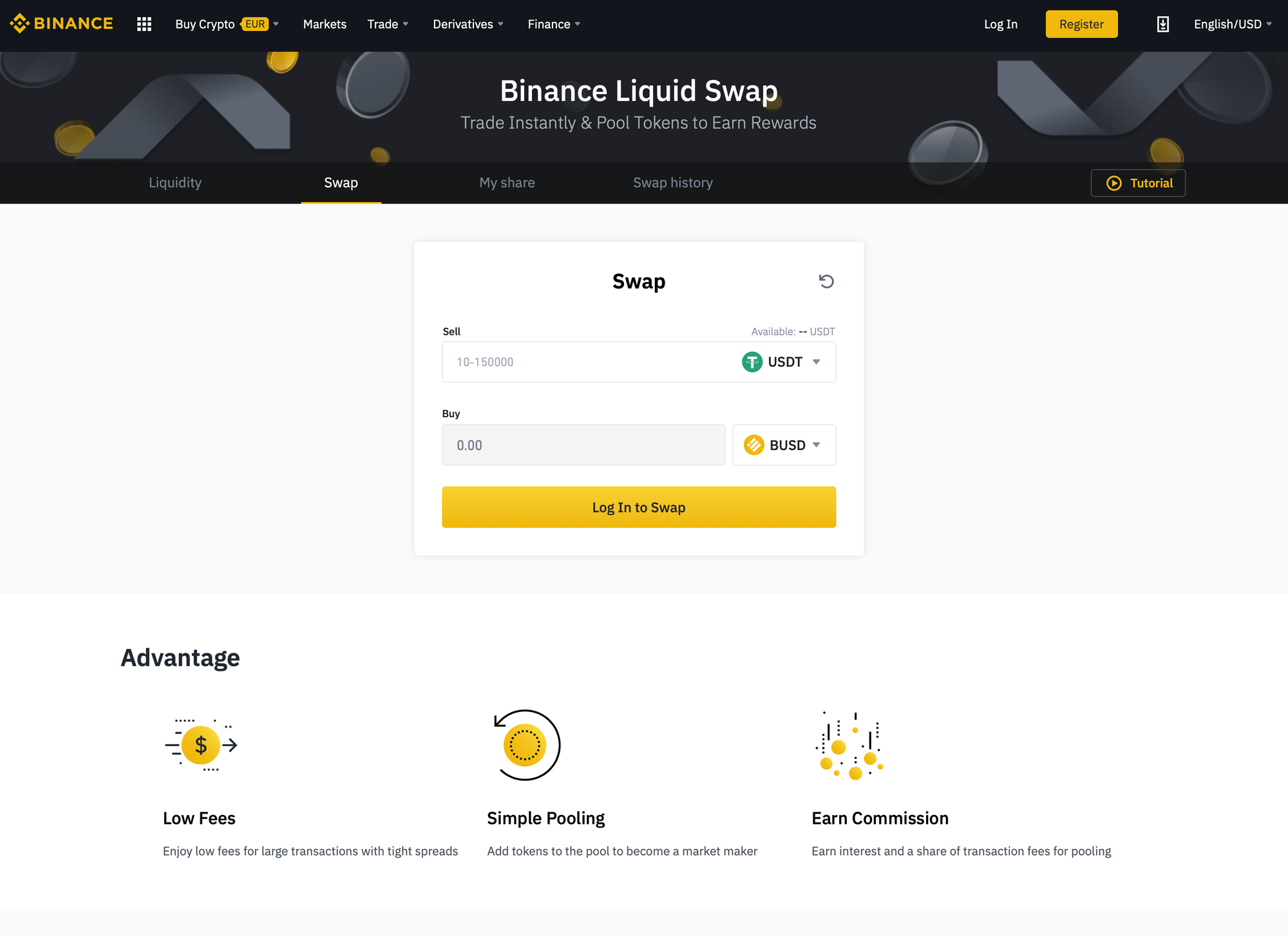

Centralized exchanges like Binance are also catching up. Binance Liquid Swap allows its users to receive interest in addition to a share of the trading fees for the pool. A so-called AMM Liquidity Pool (Automated Market Makers) allows users to provide liquidity by depositing tokens. Binance is primarily targeting Uniswap and its clones directly and will integrate with the Binance.com exchange, allowing users to bundle tokens in their wallets to earn rewards. The company is emphasizing liquidity for its own tokens, so the first pools to be offered at launch will be USDT/BUSD, BUSD/DAI and USDT/DAI.

Leverage

In addition to liquidity reduction, leverage is another key component to achieving possible extremely high returns. A leverage strategy basically means using borrowed money to increase the potential of an investment. Yield builders can deposit their coins as collateral with a credit protocol and borrow more coins. After that, they can use borrowed coins as further collateral and repeat this process several times.

**Leverage can increase profits only if the user guesses the price dynamics correctly. If a leverage farmer's prediction fails, his losses increase just as much: he loses not only his own money, but also someone else's.

Risk

Liquidation Risk: Collateral could be liquidated and repaid to lenders due to over-collateralization - when the collateral ratio (value of collateral/value of loan) falls below a certain threshold,

Liquidity shortage: A significant portion of a particular asset being held in various protocols to generate returns can lead to a liquidity shortage in the market. This results in highly volatile assets and can directly impact the asset price and return mechanism of the various protocols.

Exploitation of Smart Contracts: DeFi protocols are implemented using smart contracts, and these smart contracts are openly available to anyone. Therefore, there is always a risk that bugs will appear and smart contracts will be exploited to steal funds.

Final Thoughts

While other investment opportunities offer steady returns, your investment in Yield Farming comes with liquidation risks and risks from smart contracts. It's also hard to tell if this will pave the way for consistent long-term growth. That is, if incentives wane, farmers might quit too.

Additionally, Yield Farming is definitely not easy, yet there are more and more tools that make it easier.

- Etherscan's new Yield Farms page provides an unfiltered and comprehensive list of projects that have ongoing yield farming campaigns.

- yieldfarming.info provides a curated list of yield farming opportunities and detailed wallet-based statistics (APY, etc.).

- Zerion is a dashboard interface for blockchain-based protocols in DeFi applications; another good platform is Instadapp.

- Finally, relatively new is APY.Finance. The platform automates yield farming to "fund the best risk-adjusted cropping strategies."

The website and the information contained therein are not intended to be a source of advice or credit analysis with respect to the material presented, and the information and/or documents contained on this website do not constitute investment advice.