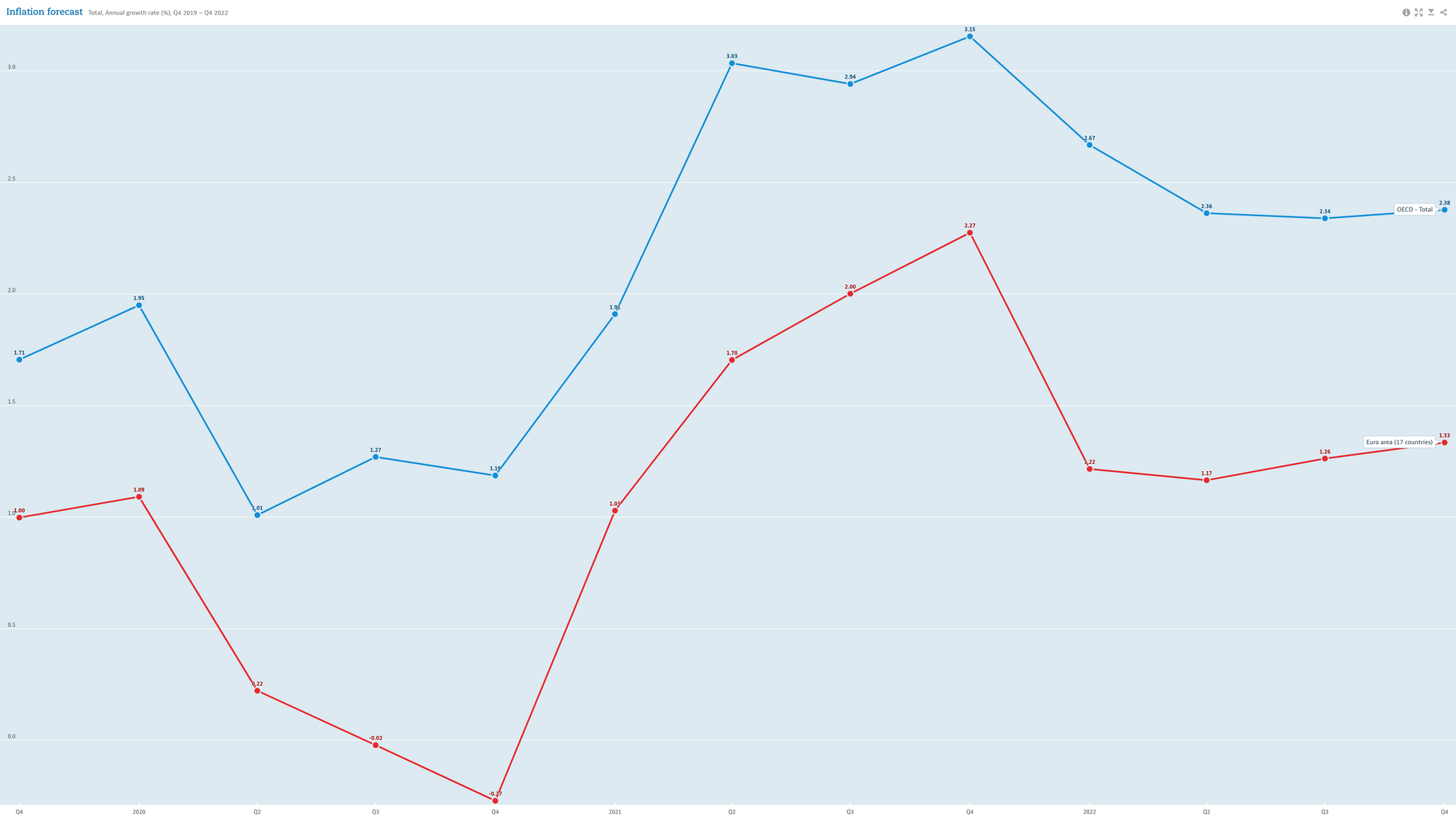

As markets have undergone significant volatility and inflation is on the rise in recent times, perhaps more individuals are looking for ways to diversify their portfolios. Historically, art and collectibles represent strong stores of value and have been relatively uncorrelated with the S&P compared to many other asset classes.

A concise history of baseball cards and how they became collectibles

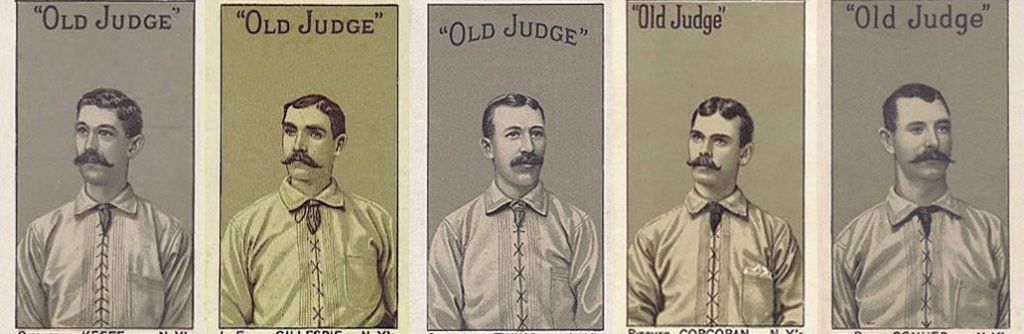

Well, were you aware that baseball cards have been around longer than Major League Baseball's National League (NL), which was founded on February 2, 1876 and is the older of the two leagues that make up MLB? The earliest cards appeared in the 1860s and looked vastly different from those of today. They were initially trade cards, a precursor to business cards. Trade cards were promotional items that were printed in large quantities and distributed free of charge to advertise businesses, products, and services.

The N167 set, developed by the Goodwin Tobacco Company, featured a dozen cards of New York Giants players to promote the Old Judge line of cigarettes. At the turn of the century, baseball cards, and tobacco products were basically synonymous with each other.

In the early 1970s, baseball card collecting began to undergo a significant change. Grown men began to form formal organizations and events around the hobby of baseball card collecting. They organized baseball card conventions, published baseball card collecting newsletters, and created local baseball trading cards. As the adult hobby became more popular, the cards became collectibles that were sold for money. Until the early 1980s, adult card collecting was a relatively small hobby. With the growth of the baseball card market combined with the speculative atmosphere of the 1980s, it grew extremely quickly and became one of the most popular adult hobbies in the United States in the early 1990s.

These days, a PSA-10 rated version of Ken Griffey Jr.'s 1989 Upper Deck Rookie card routinely sells on eBay for about US$ 1,500. Which is about 20 times what it would have brought 25 years ago.

While trading and investing in collectibles like baseball cards are not new - the way they are traded has changed significantly.

A contemporary equivalent: Otis

Otis began in 2018 by Michael Karnjanaprakorn – who had previously founded the online education platform Skillshare. As a continuation of the democratization of learning, his new goal was to democratize access to investing. Making it possible for people to invest in shares of "cultural assets," including contemporary art, sports memorabilia, rare comics, sneakers, and other collectibles – all through a mobile app. The basic idea is to tokenize assets so that the high prices of these assets become much more bearable for a normal investor.

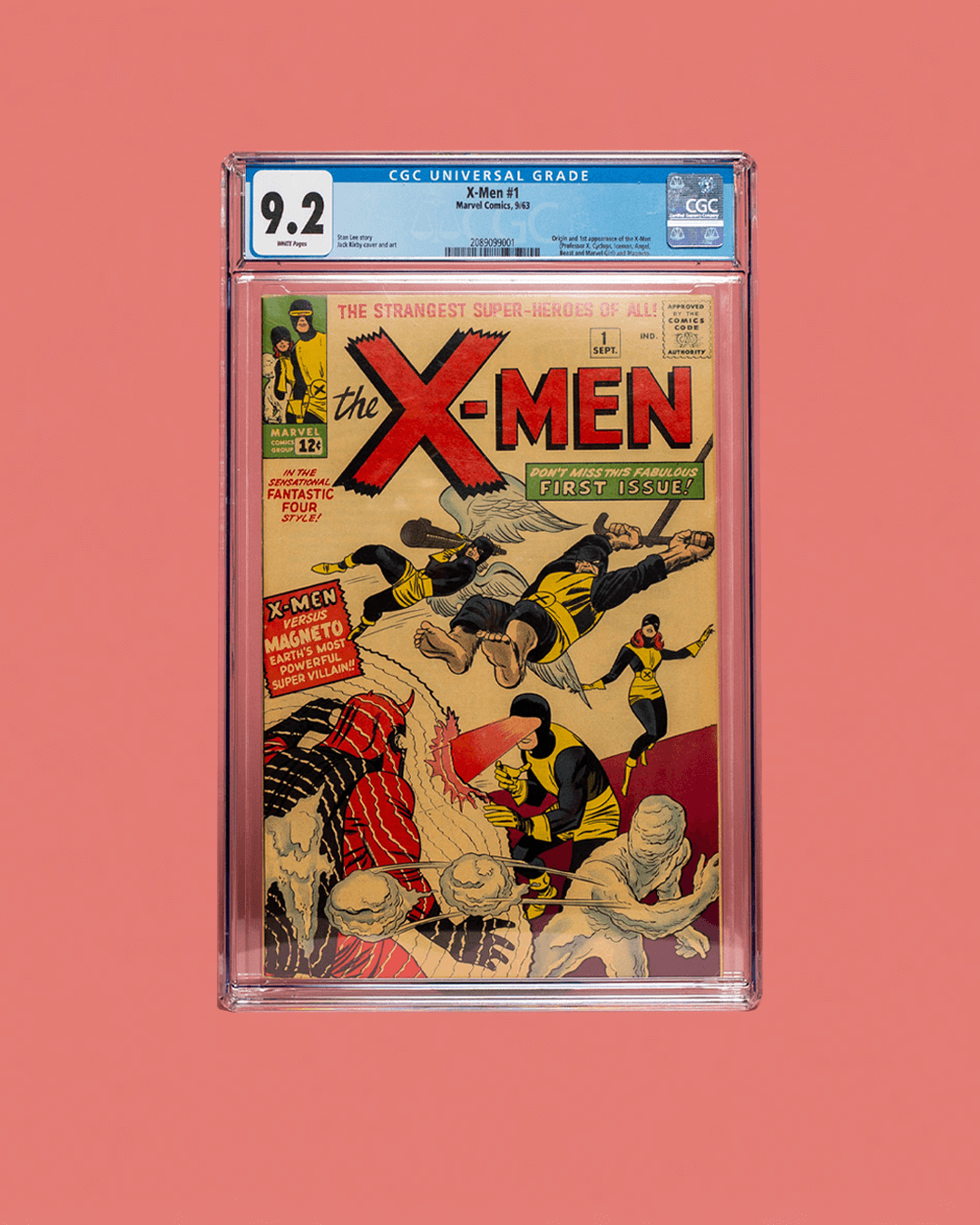

For this reason, Otis acquires cultural assets from renowned galleries, auction houses, collectors, and artists. Such assets are securitized by the SEC and converted into tokens. Some of the disposals include paintings by Banksy and KAWS, a highly graded copy of X-Men #1, a Lebron James rookie card, and a collection of original 1985 Nike Air Jordans. Very recently, a mint Pokemon Yellow: Pikachu Edition which originally sold for about US$ 30 was actually valued at nearly US$ 80,000 - all of which can be purchased for US$ 10 on the investment app Otis.

There is a 0% to 10% procurement fee (depending on the asset) charged by the venture to cover the cost of acquiring, legitimizing, and storing each collectible. In addition, Otis charges a broker-dealer fee of 1% on invested capital. Overall, fees are 5% on average.

Should Otis decide to sell an asset at a profit, those profits are divided among investors in proportion to the number of shares they own. However, each time Otis sells an asset, it takes 10% of the profit made.

When investing with Otis as an individual, investors receive a membership interest in a Series LLC. Each asset or group of assets is owned by a single Series LLC of its subsidiaries, Otis Gallery LLC and Otis Collection LLC. When investing, an individual becomes a unit holder (shareholder) in a particular Series (Subsidiary) that owns an asset or group of assets. Each series (asset) has its own EIN, bank account, and trust account. Otis Wealth, Inc. is the asset manager for each series of Otis Collection LLC and Otis Gallery LLC and has full discretion.

A similar approach for the LLC series is discussed in the following Capture the Flag article:

All assets are insured by Aspen American Insurance Company both during transit and storage. The storage of each asset is in a secure, climate-controlled facility. Many of the items are stored at UOVO Fine Art in Long Island City, NY. Most trading cards and some sports memorabilia are stored at PWCC in Tigard, OR. Occasionally Otis hosts events where you can view some of the holdings in their own gallery space in New York at 47 East 3rd Street.

Finally, it is worth mentioning that there are several similar approaches for different asset classes that will not be discussed further in this article, but are still worth mentioning:

- Masterworks, tokenization, and investment of blue-chip and established artists

- Rally – Alternative Asset Management, similar to Otis; also investments in assets such as cars (e.g., 1955 Porsche 356 Speedster; 1977 Lotus Esprit S1, 1988 Lamborghini Jalpa, etc.)

- Collectable, similar to Otis & Rally

A billion-dollar market…

In fact, the first time I wrote about the history of NFT was about 2 years ago in the article "Predicted Antiques of the Future", shortly followed by the article "Rare Digital Art - Discovering, Collecting and Exhibiting", which already covered NFT marketplaces such as OpenSea, SuperRare, and MakersPlace. For a long time, NFTs and their marketplaces have not received the attention they deserve.

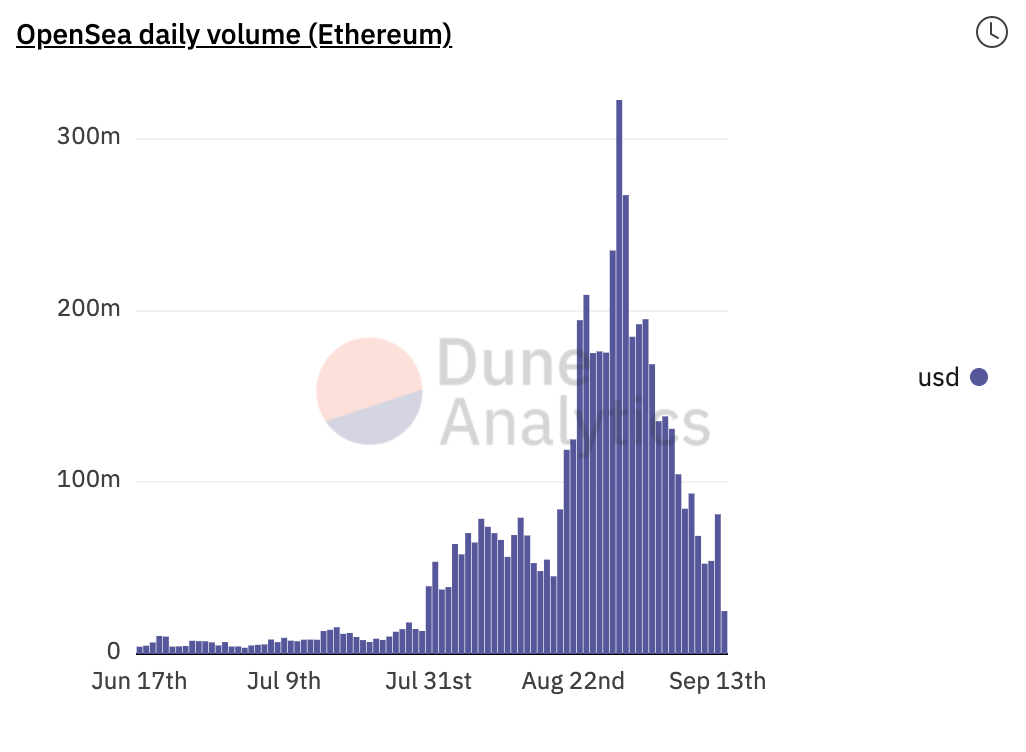

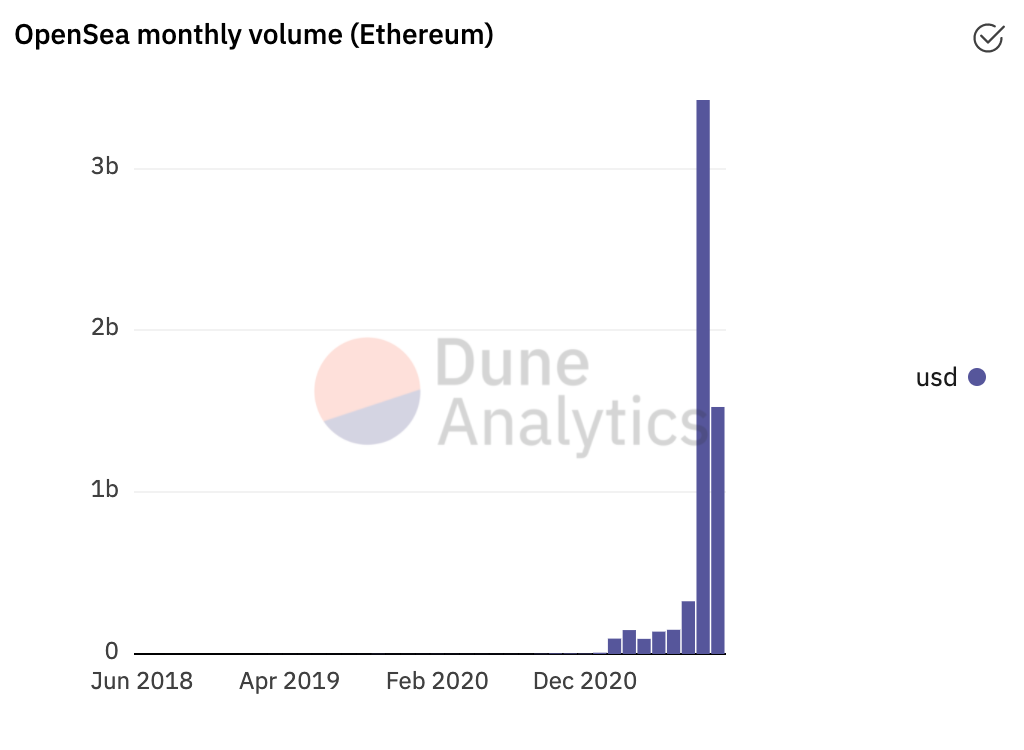

By 2021, NFTs have become a multi-billion dollar market with trading volumes recently surpassing US$ 100 million per day. OpenSea again – their monthly sales volume hit a record high of about US$ 750 million or more in August 2021 and rising.

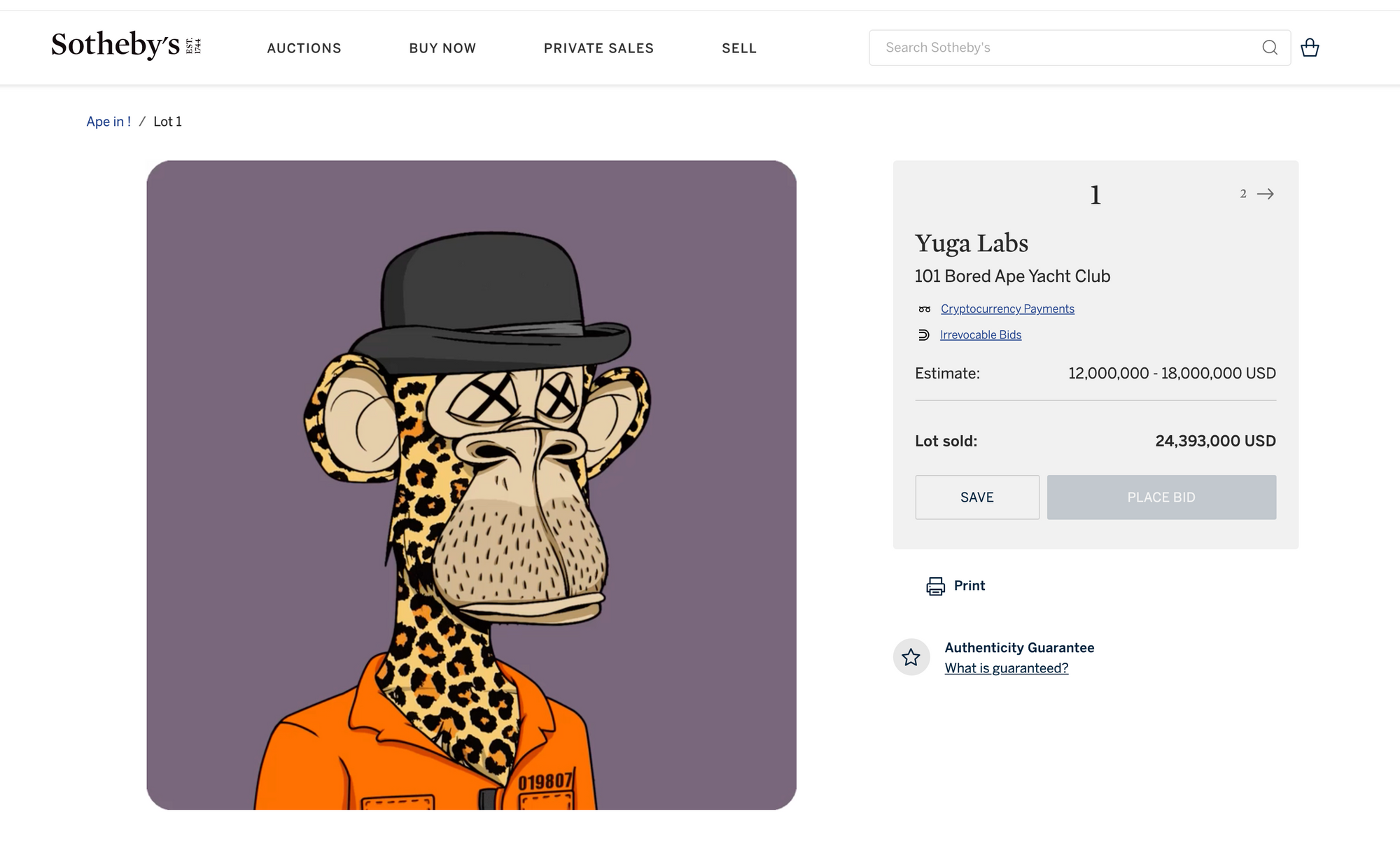

To give you some more examples of what has happened recently. On September 9, 2021, Sotheby's sold NFTs that were a part of the "Bored Ape Yacht Club" collection for US$ 24.4 million in an online sale. The 107 non-fungible coins are among 10,000 computer-generated cartoon apes produced by U.S.-based Yuga Labs.

A set of 101 "Bored Ape Kennel Club" NFTs - which are a set of dogs positioned to be marketed as pets for the apes - accompanied the sale. These dogs raised US$ 1,835,000, and the monkeys raised US$ 24,393,000, bringing the auction total to US$ 26,228,000.

A Degen Ape Academy NFT on the Solana blockchain was sold for 5980 SOL, or US$ 1.1 million, on September 11, 2021. Moonrock Capital, a London-based blockchain advisory firm, was the buyer and made the announcement via Twitter. While other Degenerate Apes in the collection have sale prices as high as US$ 1.7 million.

Moonrock Capital just acquired the 13th rarest @DegenApeAcademy NFT for 5980 $SOL ($1,109,170.40) pic.twitter.com/STkwJetRl1

— Moonrock Capital (@MoonrockCapital) September 11, 2021

Christie's continues to venture into uncharted territory. The auction house will host a sale of "Art Blocks Curated: Sets 1-3." The sets are part of the "Post-War to Present" auction series.

We're proud to announce the sale of Art Blocks Curated: Sets 1-3, as part of the Post-War to Present auction in New York on 1 October. Bidding for this lot will be conducted live in ETH—a first for any leading auction house. #NFTs #digitalart #onlineauction @artblocks_io pic.twitter.com/jDNK6VviYi

— Christie's (@ChristiesInc) September 7, 2021

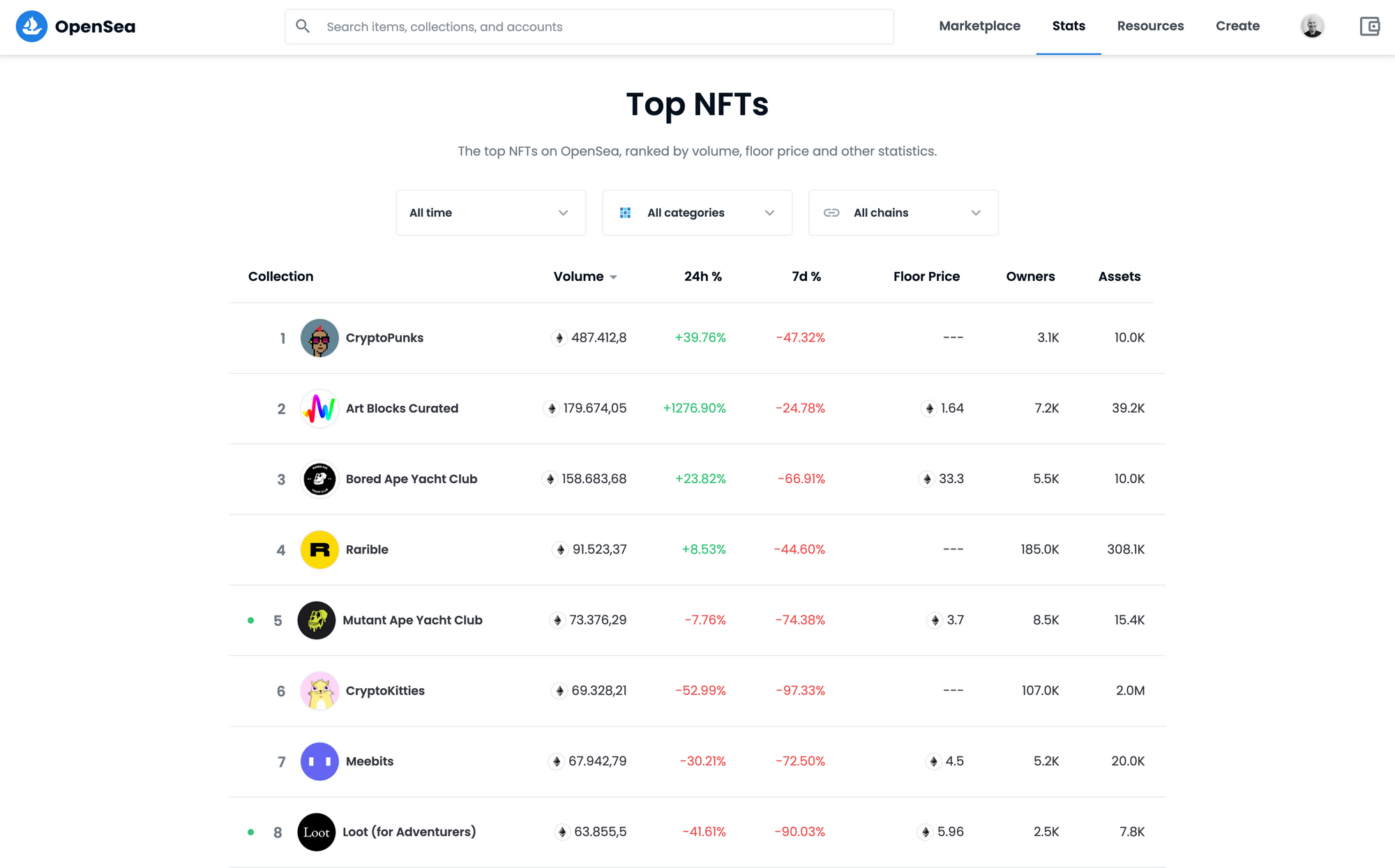

Art Blocks has turned over more than 179,000 ETH on OpenSea as of September 2021, securing a solid spot at the top of the NFT charts - second only to Crypto Punks.

…that is not yet insured

The above-mentioned dynamics result in the market size of the top collections estimated by NansΞn.ai to be over $4 billion.

#NFT collections ranked by market cap (average price x total number of NFTs in each collection) shows #cryptopunks market cap is 1,070,316 $ETH (~ 4,174,232,400 USD) now.

— NansΞn (@nansen_ai) September 4, 2021

Put it in perspective, it's almost as much as $COMP and $SUSHI combined - which is about $5b. pic.twitter.com/7XSHks4u2k

This perhaps isn't the most striking figure in the financial world, but extrapolations solely based on current market growth might result in a severe underestimation given certain subsectors (memes, online games, etc.) would increase. For example, sales in the primary market for meme NFTs have just reached eight figures; the recent emergence of faction logs, for example, is expected to accelerate this development.

This perhaps isn't the most striking figure in the financial world (also compared to the value of cryptocurrencies in the circulation of around $2 trillion total market cap), but extrapolations solely based on current market growth might result in a severe underestimation given certain subsectors (memes, online games, etc.) would increase. For example, sales in the primary market for meme NFTs have just reached eight figures; the recent emergence of faction logs, for example, is expected to accelerate this development.

To put this into perspective: The global art market has reported sales of US$ 51 billion in 2020. Though it's critical to highlight the fact that non-digital art is not sold very often - works that are purchased do not often resell in the same year - which means that US$ 51 billion does not represent the value of all art. It becomes even clearer that only an artist like Pablo Picasso has an estimated "market capitalization" in the tens of billions of dollars for his 50,000 or so works.

The best is yet to come…

When vintage car collector David MacNeil bought a Ferrari 250 GTO for US$ 70 million in 2018, he probably insured it. Why wouldn't he? On the other hand, the NFT market is more or less uninsured by the insurance industry. I beg your pardon?!

The resulting gap in protection ought to inspire insurers in their search for new business ventures. That said, has the insurance industry the confidence to underwrite this new asset class yet?

The risk, of course, is that the value of NFTs will fluctuate, much like cryptocurrencies. Yet the economic loss of value is not the only risk associated with owning an NFT. In fact, a number of NFTs have "disappeared," in other words, a broken link has resulted in the disappearance of what the NFT represented. Envision buying a painting and all of a sudden it's an empty frame.

Individuals also face the risk of losing access to their digital wallets because they forgot their passphrase or because their accounts were hacked. Under a recent attack, individuals using the NFT marketplace Nifty Gateway lost thousands of dollars worth of assets as only one example.

1/4

— Nifty Gateway (@niftygateway) March 15, 2021

We have seen no indication of compromise of the Nifty Gateway platform. The Nifty Gateway team is communicating with a small number of users who appear to have been impacted by an account takeover.

It is not the insurance industry itself that is coming up with creative solutions to solve the problem. For instance, blockchain networks are using a decentralized model to outsource risk pricing to the community. By doing so, a "decentralized prediction market" can be used to predict true probabilities and also solves the problem of data scarcity and value volatility.

Nexus Mutual, Cover Protocol, Insured, and tidal are examples of ventures in this domain. These ventures provide protection for smart contracts which are used to buy and sell NFTs. If anything goes wrong with the smart contract and a loss is incurred, a claim is made. However, these models could theoretically cover any type of risk, and these companies have ambitions beyond digital.

Nexus Mutual

As described earlier, Nexus Mutual is a community-backed insurance company in which a high-yield pool of funds stored on a blockchain pays for damages. The first product they offer is Smart Contract Cover (PDF), which protects claims against vulnerabilities of smart contracts used on various DeFi and, currently, CeFi blockchain platforms. Registered in the UK as Limited by Guarantee, a designation commonly used by not-for-profit organizations, the company is structured as an ETH-based decentralized autonomous organization (DAO) that is solely owned by its community members. The NXM token upholds membership, delivers rewards, and possesses voting rights in the governance of the Nexus Mutual network.

Any individual can also become a member of Nexus Mutual, and acquire the Nexus Mutual token (NXM). NXM can then be used to purchase insurance coverage and to participate in Nexus Mutual's governance process. NXM's governance protocol (Protcol Cover) (PDF) includes the ability to assess the risks of coverage of specific smart contracts by voting on the acceptance of claims, making NXM a multi-faceted utility token that drives the NXM ecosystem.

Nexus Mutual members, known as Risk Assessors, who typically have smart contract expertise, set the price of coverage. If the risk assessors determine a smart contract is secure, then coverage can be initiated. The risk assessors (pg. 16) pay NXM into the coverage pool. These stakes are used to pay for claims in the event of a violation, giving risk assessors an incentive to bet only on contracts they trust. Once wagered, risk assessors' tokens are locked for 90 days. The final cost of coverage is determined using a specialized equation that considers, among other things, the amount of coverage desired, the time period, and the amount of NXM deployed by the risk assessors. Risk assessors are then rewarded with a percentage of the fee paid by the company requesting coverage.

Recommended further research

- not reviewed – Cover Protocol

- not reviewed – dArt Insurance

- not reviewed – Insured

- not reviewed – Polkacover

- not reviewed – tidal; "Higher Yields Protocol Insurance"

- not reviewed – yinsure

Final Thoughts

Such market potential from an insurance perspective is unrivaled? And why?

Despite the risks, dealing with the volatility of NFTs and their regulatory limitations. NFTs are likely to play an important role in the investment market in the future.

If insurers are to keep pace with evolving technology, a comprehensive understanding of how NFTs work is a necessary first step for those who want to participate. Otherwise, there is an even greater risk that new companies will not only provide protection for smart contracts used to buy and sell NFTs, but will adapt their models to cover any type of risk and go beyond on-chain assets, e.g., in the form of tokenized physical assets.

The website and the information contained therein are not intended to be a source of advice or credit analysis with respect to the material presented, and the information and/or documents contained on this website do not constitute investment advice.